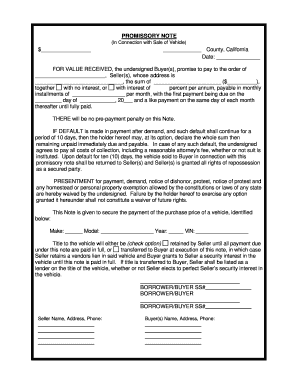

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Get the free promissory note for vehicle purchase form

Show details

PROMISSORY NOTE (In Connection with Sale of Vehicle) $ County, Arizona Date: FOR VALUE RECEIVED, the undersigned Buyer(s), promise to pay to the order of, Seller(s), whose address is, the sum of ($),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your promissory note for vehicle form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note for vehicle form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing promissory note for vehicle purchase online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit promissory note for car loan form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out promissory note for vehicle

How to fill out promissory note for car:

01

Gather necessary information: Before filling out the promissory note, make sure to have all the pertinent information about the car and the parties involved. This includes the full names, addresses, and contact information of the buyer and seller, as well as the details of the car, such as make, model, year, and vehicle identification number (VIN).

02

Include the loan terms: Specify the loan amount, the interest rate (if any), the repayment schedule, and any other important terms of the loan. It is crucial to be clear and concise in outlining all the details to avoid confusion or disputes in the future.

03

Indicate collateral: If the car being purchased with the loan serves as collateral, explicitly mention it in the promissory note. This ensures that the lender has a legal claim on the vehicle until the loan is fully repaid.

04

Include signatures and date: Both the buyer and the seller need to sign the promissory note to make it legally binding. Additionally, include the date of signing to establish the timeline of the agreement. It is recommended to have the signatures notarized to add an extra layer of authentication.

05

Keep a copy: Once the promissory note is completed and signed, make sure to make copies for both parties. This helps in case any disputes or legal issues arise in the future and provides each party with their own records of the agreement.

Who needs promissory note for car:

01

Individuals buying a car on installment: If someone is purchasing a car but does not have the full funds to pay for it upfront, they may choose to enter into a loan agreement with the seller. In such cases, a promissory note becomes necessary to outline the terms and conditions of the loan.

02

Private sellers offering financing: When a private seller decides to offer financing options to buyers instead of requiring full upfront payment, a promissory note is needed to establish the terms of the loan. This provides legal protection for both the buyer and the seller throughout the repayment period.

03

Financial institutions or lenders: Banks, credit unions, or other financial institutions that offer car loans to individuals also require a promissory note. This serves as a legally binding agreement between the lender and the borrower, outlining the terms of the loan and the repayment schedule.

04

Legal and financial advisors: Even if one is not directly involved in the transaction, legal and financial advisors often play a crucial role in guiding individuals through the process of buying a car and may recommend the use of a promissory note to protect their clients' interests.

Fill promissory note template for vehicle : Try Risk Free

People Also Ask about promissory note for vehicle purchase

Does a personal promissory note need to be notarized?

Can you write your own promissory note?

Can you write yourself a promissory note?

How do I write a promissory note for borrowing money?

How do I write a promissory note for my car?

Can you use a promissory note to buy a car?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file promissory note for car?

The seller of the car is usually required to file a promissory note with the state's Department of Motor Vehicles when a car is sold on credit. This document serves as proof that the buyer has agreed to pay the seller the full amount for the car, and it is used to register the vehicle in the buyer's name.

What information must be reported on promissory note for car?

A promissory note for a car should include the following information:

1. The amount of the loan, including the principal and any interest.

2. The date the loan was taken out.

3. The name, address, and contact details of both the lender and the borrower.

4. The terms of the loan, including the repayment schedule, interest rate, and any late payment fees.

5. The make, model, and year of the car being purchased and its Vehicle Identification Number (VIN).

6. The date the loan is due and any applicable consequences for late payments.

7. The terms of the security agreement between the lender and the borrower, including the collateral used to secure the loan.

8. The signature of both parties, as well as any witnesses.

What is promissory note for car?

A promissory note for a car is a legally binding document that outlines the terms and conditions of a loan used to purchase a vehicle. It includes information such as the names of the borrower and lender, the loan amount, interest rate, repayment schedule, and any consequences for defaulting on the loan. The promissory note serves as evidence of the borrower's promise to repay the loan and provides security for the lender.

How to fill out promissory note for car?

To properly fill out a promissory note for a car, follow these steps:

1. Download or obtain a blank promissory note form specific to your jurisdiction or state. Make sure it includes all the necessary fields for a car loan, such as the borrower's and lender's name and contact information, car details, loan amount, repayment terms, and interest rate if applicable.

2. Begin by entering the date at the top of the promissory note.

3. Identify the parties involved: Write the full name, address, and contact information of both the borrower (buyer) and the lender (seller).

4. Describe the car: Provide accurate details about the vehicle being purchased, such as the make, model, year, VIN (Vehicle Identification Number), and any other relevant information.

5. Specify the loan amount: Clearly state the total amount being loaned by the lender to the borrower to purchase the car.

6. Outline the repayment terms: Specify the repayment schedule, including the number of installments, amount due for each installment, and the due date for each payment. You may also include information about late fees or penalties for missed payments.

7. Include any interest rates: If there is an interest rate associated with the loan, clearly state it on the promissory note.

8. Indicate any collateral or security interest: If the car is used as collateral for the loan, clearly mention this in the promissory note. Include details regarding the consequences of default, repossession, and sale of the collateral.

9. Include an acceleration clause: Consider adding a provision allowing the lender to demand the entire loan amount to be paid immediately if the borrower breaches any terms of the promissory note.

10. Include any additional terms or conditions: If there are any specific terms or conditions relevant to the loan, such as insurance requirements or maintenance responsibilities, include them in the promissory note.

11. Sign and date the document: Both the borrower and the lender should sign and date the promissory note in the presence of a notary public (if required by your jurisdiction) to validate the agreement.

Remember to keep a copy of the fully executed promissory note for both parties' records.

Note: It is advisable to consult with a legal professional or attorney to ensure that the promissory note meets all legal requirements and to address any specific circumstances or legal concerns.

What is the purpose of promissory note for car?

A promissory note for a car is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller of the vehicle. Its purpose is to provide evidence of the loan and to establish the borrower's promise to repay the loan amount with interest within a specific period of time. The promissory note includes details such as the loan amount, interest rate, repayment schedule, consequences of defaulting on the loan, and any other terms agreed upon by both parties. It serves to protect the seller's financial interests and ensures that the buyer understands their obligations and responsibilities in repaying the loan.

What is the penalty for the late filing of promissory note for car?

The penalty for late filing of a promissory note for a car will vary depending on the terms and conditions agreed upon between the parties involved. However, generally speaking, late filing may result in penalties such as late fees, increased interest rates, or even repossession of the car in some cases. It is important to carefully review the terms of the promissory note and consult with the lender or financing institution to understand the specific penalties that may apply.

How do I edit promissory note for vehicle purchase online?

The editing procedure is simple with pdfFiller. Open your promissory note for car loan form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my bill of sale with promissory note for automobile in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your vehicle promissory note template right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit vehicle promissory note straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing auto loan promissory note form.

Fill out your promissory note for vehicle online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bill Of Sale With Promissory Note For Automobile is not the form you're looking for?Search for another form here.

Keywords relevant to auto promissory note form

Related to car loan promissory note

If you believe that this page should be taken down, please follow our DMCA take down process

here

.